5 Common Accounting Mistakes New Business Owners Make And How To Avoid Them

9 December 2024, 10:22 am

Posted in: Investment ready

Home Blog Investment ready 5 Common Accounting Mistakes New Business Owners Make And How To Avoid Them

The following content is a guest post by one of our trusted partners, Outbooks, providing expert tips to enhance your accounting and bookkeeping efficiency.

If you own a new business, you might feel overwhelmed by your accounting tasks. Learning some basics of accounting can be helpful, but it’s easy to make mistakes.

Mistakes in accounting can add up over time and affect your entire financial picture. For example, if you forget to record an expense, it can lead to errors in your net income, profit margins, and other key figures. One small mistake can quickly lead to many others.

The best way to become better at accounting is through practice. However, many new business owners don’t have much time. They might think about hiring an experienced firm for help or look for a quick course to learn the essentials. This can help them avoid common mistakes.

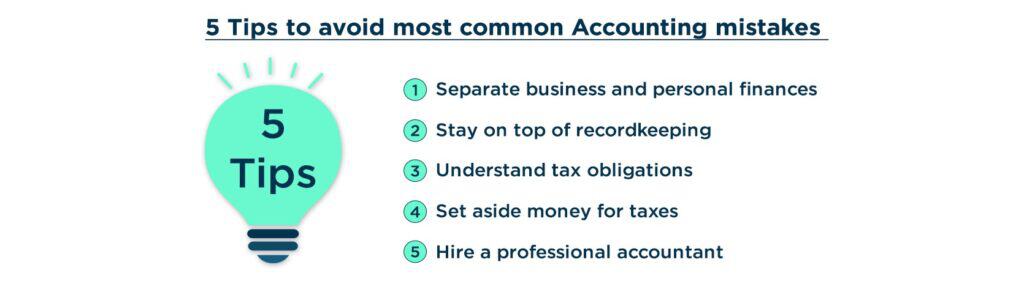

In this article, we will cover five common accounting mistakes that business owners often make. By understanding these mistakes and why they should be avoided, you can improve your bookkeeping practices.

Explanation – We will look at accounting errors from a statistical viewpoint to understand how common and costly these mistakes can be. A report from IBM states that poor-quality data costs the US about $3.1 trillion each year. This is a huge amount. It’s important to consider not just the errors themselves but also their consequences. Financial decisions are often based on incorrect data, which can lead to even bigger problems.

Consequences – Many losses faced by small business owners can be linked to accounting mistakes. A report by Clutch found that among the top five reasons for financial challenges, 23% were due to mixing personal and business finances, 11% were caused by clerical errors, and another 11% came from outdated financial records. It’s important to note that these issues are part of broader financial problems, which also include unforeseen expenses (35%) and delays in payments (21%).In total, small business owners reported that 45% of their financial difficulties stemmed from errors and mistakes. This is a significant portion of their challenges.

Solutions – The good news is that with careful planning and proper implementation, small business owners can reduce these errors significantly. By focusing on better accounting practices and using reliable tools, they can improve their financial management and minimize costly mistakes.

Explanation – Regular bookkeeping is important for keeping financial records organized. Many small business owners skip this task. They may not have enough time or they might not see how important it is. This can lead to messy records and financial problems.

Consequences – Not keeping up with bookkeeping can cause missed deductions, cash flow issues, and wrong financial statements. It can also make it hard to find and fix mistakes quickly. Over time, ignoring bookkeeping can hurt your ability to make smart business choices and may lead to expensive penalties during tax time.

Solution – Set aside time each week to update your books. This can include entering receipts, balancing accounts, and checking financial statements. If you struggle with bookkeeping, think about outsourcing bookkeeping services. The company to which you will outsource can help keep your records accurate and up-to-date, so you can focus on growing your business.

Explanation – Not delegating enough can be a common issue for small business owners. While using accounting software like QuickBooks, Xero, or FreshBooks can reduce human errors in data entry, it is still wise to hire a bookkeeper or accountant. A professional can recommend good software and assist you with your first tax preparation after you start using it.

Consequences – Many small business owners do not see the need to delegate tasks to professionals or invest in quality software. This can lead to more errors and missed opportunities for profit. For example, if a business continues to print and mail invoices instead of using an online invoicing system, it may waste time and money. A report by Billentis showed that companies can save up to 80% on invoice costs by making this switch.

Solutions – Business owners who embrace changes like automation often see great success. Automating accounting and bookkeeping tasks can save time and reduce mistakes. By delegating responsibilities and using technology wisely, you can improve your business’s efficiency and profitability.

Explanation – Recording sales is a key part of accounting. However, many businesses do not treat all sales as cash that can be used right away. Issues like overcharges, delays in payment, personal bankruptcies, and fraud can make it seem like money is earned, but it may not be available.

Consequences – If you assume that all accounts owed will be paid, you might face problems later. This can lead to overstated revenue when tax season arrives. It can also make it harder to keep your financial records accurate.

Solution – To avoid these issues, it’s important to write off some accounts receivable as “bad debts.” This step can help your books balance more easily. Since the amount of bad debts varies by industry, it’s helpful to research what your business might expect to lose.

Explanation – In the early days of running a business, you may have many financial transactions each day. While a $100,000 loan from a credit union is hard to forget, small expenses like $10 for gas can easily be missed.

Consequences – Small transactions of $2, $5, or $10 might not seem important. However, they can significantly impact your overall financial health. For example, if you spend $10 daily, that adds up to $3,650 in a year. Not tracking these expenses makes your financial records less useful. You won’t know where to cut costs or how efficiently your business is running.

Solution – To improve your accounting, make sure to record every transaction, no matter how small. It may feel tedious, but tracking all expenses will help your business reach its goals.

In conclusion, avoiding common accounting mistakes is crucial for the success of new business owners. By addressing issues like mixing personal and business finances, neglecting bookkeeping, failing to track expenses, not reconciling bank statements, and ignoring cash flow management, you can maintain accurate financial records and make informed decisions.

One effective solution to accounting challenges is outsourcing your financial tasks. By hiring professionals, you ensure accuracy and compliance while freeing up time to grow your business. Outsourcing reduces costs and gives you access to expertise and advanced tools. Outbooks is a good choice for businesses looking to outsource their accounting. They offer various services, including bookkeeping, management accounts accounts payable, accounts receivable, company secretarial, and more. This approach allows you to focus on your main activities while benefiting from experienced professionals. It can lead to better financial clarity and efficiency for your business.